The Rapaport Diamond Report 2023 provides a comprehensive analysis of diamond market trends, pricing, and industry insights. It serves as a benchmark for diamond valuation, offering detailed data on round brilliant cut diamonds by carat weight and clarity grade, based on GIA grading standards. The report is widely recognized as a critical resource for jewelers, investors, and industry professionals, helping them navigate market dynamics and make informed decisions. It reflects high cash asking prices, which may be discounted, and offers a detailed perspective on diamond price trends and market performance throughout the year.

1.1 Overview of the Rapaport Diamond Report

The Rapaport Diamond Report provides detailed pricing data for round brilliant cut natural diamonds, categorized by carat weight and clarity grade. It serves as a benchmark for the diamond industry, offering insights into market trends and pricing dynamics. The report is widely used by jewelers, investors, and professionals to assess diamond value and make informed decisions.

1.2 Importance of the Report in the Diamond Industry

The Rapaport Diamond Report is a critical benchmark for diamond pricing and market trends, providing essential data for industry professionals. It serves as a standardized reference for evaluating diamond value, enabling informed decision-making for jewelers, investors, and traders. Its insights are vital for understanding market dynamics and setting prices, making it indispensable in the diamond trade.

Key Findings of the Rapaport Diamond Report 2023

The report highlights diamond price stabilization in early 2023, followed by declines due to weaker retail sales and competition from synthetic diamonds. It also notes regional demand shifts, with slowing growth in China and recovery in the U.S. and Europe. The data provides insights into market trends and pricing dynamics, guiding industry stakeholders.

2.1 Diamond Price Trends in 2023

Diamond prices showed initial stabilization in early 2023 but declined in September due to weaker retail sales and competition from synthetic diamonds. The Rapaport Price List reflected these trends, with polished diamond prices dropping as inventories remained high. Regional demand shifts also influenced pricing, with slower growth in China and recovery in the U.S. and European markets.

2.2 Impact of Synthetic Diamonds on Pricing

Synthetic diamonds significantly influenced pricing in 2023, trading at up to 98% below the Rapaport Price List. Their lower cost and perceived value pressured traditional diamond sales, creating market competition. Retailers faced challenges as consumers opting for synthetics perceived better deals, impacting profit margins and forcing the industry to adapt pricing strategies for natural diamonds.

2.3 Regional Demand and Market Performance

- The US and European markets showed stable demand, driven by luxury consumer recovery post-pandemic.

- Chinese demand slowed due to economic uncertainties and increased competition from synthetic diamonds.

- India emerged as a growth market, with younger consumers and effective marketing campaigns boosting sales.

Market Trends and Analysis

The luxury goods market rebounded strongly post-pandemic, with diamond demand showing resilience. However, challenges like high inventories and synthetic diamond competition impacted traditional sales and pricing dynamics globally.

3.1 Recovery of the Luxury Goods Market Post-Pandemic

The luxury goods market, including diamonds, rebounded strongly post-pandemic, with consumer demand reaching pre-COVID levels. High-end jewelry and watches saw significant growth, driven by pent-up demand and economic recovery. The Rapaport Report highlighted that luxury brands capitalized on this resurgence, with diamond sales benefiting from increased consumer spending and a shift towards premium products.

3.2 Challenges Faced by the Diamond Industry in 2023

The diamond industry faced significant challenges in 2023, including high inventory levels, reduced demand, and increased competition from synthetic diamonds. Economic uncertainty and fluctuating consumer confidence further impacted sales. The rise of lab-grown diamonds also pressured traditional diamond pricing, creating profitability challenges for manufacturers and retailers. These factors underscored the need for strategic adaptations to remain competitive.

3.3 The Role of Emerging Markets in Diamond Demand

Emerging markets played a pivotal role in driving diamond demand in 2023, with countries like India and China showing significant growth. Rising disposable incomes and cultural preferences for diamonds fueled consumption. These markets countered slower demand in established regions, highlighting their importance in sustaining industry growth and balancing global market dynamics effectively.

Factors Influencing Diamond Prices

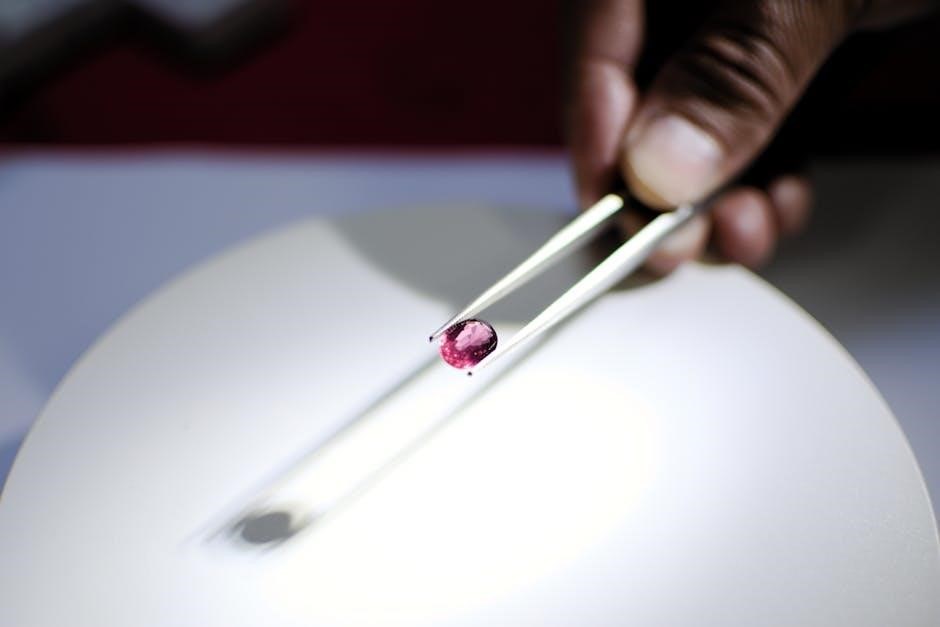

Diamond prices are influenced by the 4Cs (carat, color, clarity, cut), market demand, and supply dynamics. Cut quality significantly impacts value, with well-cut diamonds commanding premiums. Certification from organizations like GIA also plays a crucial role in determining price, ensuring authenticity and quality standards are met, which directly affect market value and consumer trust.

4.1 The 4Cs of Diamond Pricing

The 4Cs—carat, color, clarity, and cut—form the foundation of diamond pricing. Carat measures weight, affecting price significantly. Color grades range from colorless (D) to light yellow (Z). Clarity assesses inclusions and blemishes. Cut quality, including proportions and polish, greatly impacts brilliance and value, with excellent cuts demanding higher prices. These factors collectively determine a diamond’s value, as outlined in the Rapaport Diamond Report.

4.2 Impact of Cut Quality on Prices

Cut quality significantly impacts diamond prices, with excellent cuts commanding substantial premiums. Well-proportioned, polished diamonds exhibit greater brilliance, increasing their value. Conversely, poorly cut stones often trade at large discounts. The Rapaport Diamond Report emphasizes cut quality as a critical factor in determining price, reflecting market demand for optimal brilliance and fire in round brilliant cut diamonds.

4.3 Role of Certification in Determining Value

Certification plays a pivotal role in determining diamond value by ensuring transparency and credibility. The Rapaport Diamond Report references GIA grading standards, emphasizing the importance of independent verification. Diamonds with recognized certifications command higher prices, as they assure buyers of quality and authenticity, directly influencing market value and buyer confidence in the diamond’s characteristics and worth.

Regional Diamond Demand

Regional demand varies significantly, with the US and Europe showing steady recovery, while China experiences a slowdown. India’s market demonstrates growth, driven by increasing consumer demand and retail expansion.

5.1 Demand in the US and European Markets

The US and European markets showed steady recovery in 2023, driven by strong consumer demand for luxury goods post-pandemic. The luxury sector rebounded, with diamonds benefiting from renewed interest in high-quality jewelry. Engagement rings and luxury pieces saw stable demand, supported by favorable market conditions. However, economic uncertainties and inflation impacted consumer spending, though these regions remain key drivers of global diamond demand.

5.2 Slowdown in Chinese Diamond Demand

China’s diamond demand slowed in 2023, contrasting with improving gold demand. Economic challenges and shifting consumer preferences contributed to reduced sales. The market faced headwinds, with polished diamond inventories remaining high amid weaker retail performance. This slowdown underscores the impact of economic uncertainty on luxury purchases, affecting the global diamond industry’s growth prospects.

5.3 Growth of the Indian Diamond Market

India’s diamond market showed robust growth in 2023, driven by a strong economy and rising disposable incomes. The cultural significance of diamonds in Indian weddings and festivals continued to fuel demand. Effective marketing campaigns and a growing middle class further supported this expansion, positioning India as a key driver of global diamond market growth.

Investment Potential of Diamonds

Diamonds offer unique investment opportunities due to their rarity and durability. The Rapaport Diamond Report highlights their potential as a stable asset, comparable to gold and real estate, appealing to diversify portfolios.

6.1 Diamonds as an Investment Asset

Diamonds are emerging as a unique investment asset due to their rarity, durability, and aesthetic value. The Rapaport Diamond Report 2023 highlights their potential as a tangible asset, offering diversification benefits and long-term appreciation, making them an attractive option for investors seeking alternatives to traditional financial instruments.

6.2 Comparison with Other Investment Assets

Diamonds differ from traditional investments like stocks or gold due to their unique characteristics. The Rapaport Diamond Report 2023 notes that diamonds offer portability and emotional value, while lacking correlation with financial markets, making them a distinctive diversification tool. However, their illiquidity and subjective pricing contrast with more liquid assets, requiring careful consideration.

6.3 Risks and Considerations for Diamond Investments

Investing in diamonds carries unique risks, including market volatility and illiquidity. The Rapaport Diamond Report 2023 highlights that prices can be subjective, influenced by the 4Cs and certification. Additionally, the rise of lab-grown diamonds impacts demand and pricing, while high inventory levels and competition from synthetics pose challenges. Investors must carefully assess these factors for informed decisions.

Challenges in the Diamond Industry 2023

The diamond industry faced high inventory levels, reduced demand, and competition from synthetic diamonds in 2023. These factors, along with shifting consumer perceptions, posed significant challenges to market stability and profitability.

7.1 High Inventory Levels and Reduced Demand

In 2023, the diamond industry grappled with elevated inventory levels and weakened demand, leading to pricing pressures. High inventory relative to sales expectations, coupled with declining consumer demand, resulted in slower trading and downward price adjustments, as reported in the Rapaport Diamond Report. This imbalance underscored the sector’s struggle to maintain profitability amid shifting market dynamics.

7.2 Impact of Synthetic Diamonds on Traditional Sales

The rise of synthetic diamonds intensified competition, impacting traditional diamond sales in 2023. Lab-grown diamonds, priced significantly lower, attracted price-sensitive consumers, leading to reduced demand for natural diamonds. This shift pressured traditional diamond pricing, as synthetic alternatives gained market share, altering consumer preferences and forcing the industry to adapt to changing dynamics and perceptions.

7.3 Consumer Perception and Buying Behavior

Consumer perception shifted in 2023, with increasing awareness of synthetic diamonds influencing buying behavior. Many consumers opted for lab-grown diamonds due to their lower prices and perceived sustainability, while others remained loyal to natural diamonds for their emotional and investment value. This dichotomy highlighted evolving preferences, with younger buyers driving demand for affordable, ethically sourced options, prompting the industry to adapt its marketing strategies accordingly.

The Rise of Lab-Grown Diamonds

Lab-grown diamonds gained significant traction in 2023, driven by advancements in technology and shifting consumer preferences. Their lower prices and perceived sustainability attracted budget-conscious buyers, reshaping market dynamics and challenging traditional diamond sales.

8.1 Market Growth of Synthetic Diamonds

The synthetic diamond market experienced notable growth in 2023, fueled by technological advancements and consumer demand for affordable, sustainable options. Lab-grown diamonds accounted for a significant share of sales, particularly in the 1-2 carat range, as their lower prices attracted younger buyers and jewelers seeking cost-effective solutions without compromising on quality or brilliance.

8.2 Pricing Comparison Between Natural and Lab-Grown Diamonds

In 2023, synthetic diamonds traded at 30-40% below natural diamonds, with larger stones seeing even greater disparities. Lab-grown options offered significant cost savings, appealing to budget-conscious buyers. Despite this, natural diamonds retained premium pricing due to their rarity and emotional value. Notably, synthetics sometimes traded as low as 98% below the Rapaport Price List. The price gap is expected to narrow as technology advances and consumer acceptance grows.

8.3 Industry Response to the Rise of Synthetics

The diamond industry has actively responded to the rise of lab-grown diamonds by emphasizing the value of natural stones. Companies like De Beers and others have invested in technology and marketing to differentiate natural diamonds. Education campaigns and transparency initiatives aim to maintain consumer trust and highlight the unique appeal of natural diamonds in a competitive market.

Future Outlook for the Diamond Industry

The diamond industry’s future looks promising, with technology driving innovation and sustainability. Growth in emerging markets and a rebound in luxury demand are expected to fuel recovery and resilience.

9.1 Expected Market Trends for 2024 and Beyond

The diamond industry is expected to see steady growth in 2024, driven by recovering luxury demand and emerging markets. Lab-grown diamonds will continue to influence pricing, while natural diamonds may see premium pricing for larger, high-quality stones. Technology advancements and sustainability efforts are anticipated to shape the industry’s future, ensuring resilience and adaptability in a competitive market landscape.

9.2 Opportunities for Growth in Emerging Markets

Emerging markets, particularly in Asia and the Middle East, present significant growth opportunities for the diamond industry. India’s young population and rising income levels are driving demand, while other regions are showing increased interest in luxury goods. These markets are expected to play a crucial role in sustaining industry growth in the coming years.

9.3 Role of Technology in Shaping the Industry’s Future

Technology is transforming the diamond industry through innovative solutions. Blockchain enhances transparency by tracking diamonds from mine to market, while AI improves pricing accuracy and consumer experiences. Lab-grown diamonds, produced with advanced technologies, are gaining traction, offering sustainable alternatives. These advancements are reshaping industry dynamics, ensuring a competitive and efficient market landscape.

The Rapaport Diamond Report 2023 highlights key trends, challenges, and opportunities, providing essential insights for stakeholders. It underscores the evolving market dynamics and the industry’s future trajectory.

10.1 Summary of Key Insights from the Report

The Rapaport Diamond Report 2023 provides a detailed analysis of market trends, noting stabilized diamond prices, increased competition from synthetic diamonds, and shifting regional demand. It highlights slow demand in China, strength in US and European markets, and recovery in luxury goods post-pandemic, while also addressing challenges and opportunities for future growth.

10.2 Implications for Industry Stakeholders

The report underscores the need for stakeholders to adapt to shifting market dynamics, including synthetic diamond competition and evolving consumer preferences. Retailers and investors must focus on inventory management, pricing strategies, and transparency to remain competitive. The findings highlight the importance of innovation and ethical practices to sustain growth and consumer trust in the diamond industry.